Nerd Wallet is a platform that makes personal finance easier for everyone. Whether you want to compare financial products, track your credit score, or understand how to grow your net worth, this tool provides simple resources. Instead of guessing about money decisions, users can rely on guides and calculators to plan better.

Because managing money can feel confusing, many people look for tools that simplify the process. Nerd Wallet has become popular by offering step-by-step guidance. With clear explanations and useful comparisons, it helps both beginners and experienced users take control of their financial journey.

Table of Contents

What is Nerd Wallet?

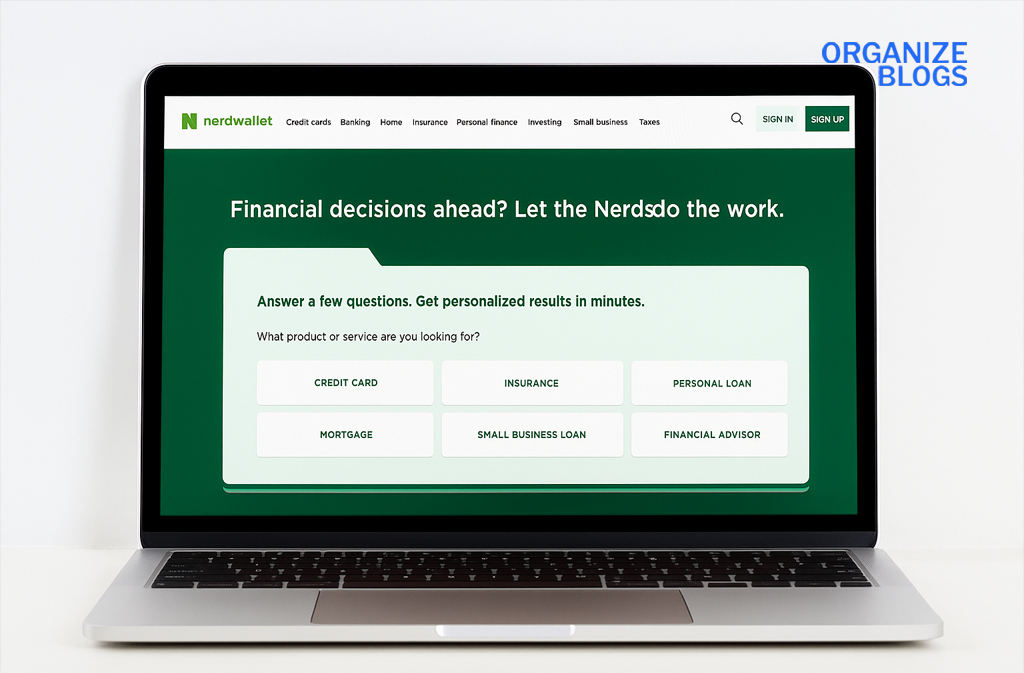

At its core, Nerd Wallet is an online financial platform designed to help people make smarter choices about money. It covers a wide range of financial products like credit cards, loans, banking options, and insurance. Instead of jumping from site to site, users can find everything in one place.

Additionally, it offers calculators, articles, and expert advice. These tools make it easier to plan for the future, build savings, and avoid mistakes. Since the platform is free to use, it is a great option for anyone who wants to understand money without paying for financial advisors.

Why People Use This

One reason many people trust Nerd Wallet is its ability to simplify complex information. Instead of financial jargon, the site uses everyday language. As a result, even young adults or beginners can understand how money works.

Moreover, the platform allows people to compare options side by side. For example, if you need a credit card, you can see different offers, fees, and rewards in one chart. This saves time and helps you pick what fits your needs best.

Nerd Wallet and Financial Products

A major feature of Nerd Wallet is its collection of financial products. These include savings accounts, personal loans, student loans, mortgages, and investment accounts. Each product is explained clearly so you know the pros and cons before making a decision.

In addition, Nerd Wallet provides reviews and ratings. By reading these, users can feel confident about their choices. Having access to this information helps people avoid mistakes and manage their money wisely.

How This Platform Helps with Credit Score

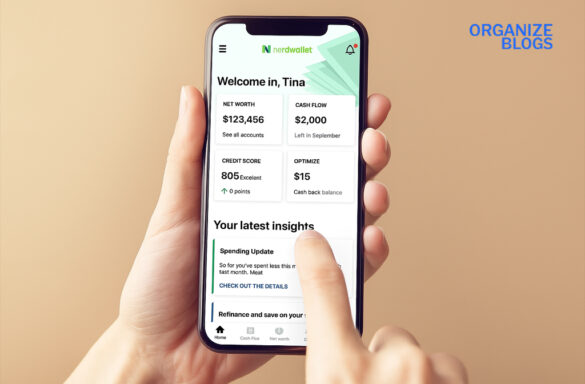

Your credit score is an important part of your financial life. Nerd Wallet makes it easy to check your score for free and track changes over time. Since many banks and lenders use credit scores to decide loan approvals, this feature is extremely valuable.

Not only does the platform show your score, but it also explains why it may have gone up or down. By offering tips to improve your credit, it gives you a chance to make smarter financial moves. This guidance can eventually lead to lower interest rates and better loan offers.

Tracking Your Net Worth with Nerd Wallet

Another helpful feature is the ability to track your net worth. Net worth is simply the difference between what you own (assets) and what you owe (debts). Nerd Wallet provides tools to add your accounts and calculate this automatically.

Furthermore, tracking net worth shows progress over time. As you pay off debt and grow savings, you can see how your financial health improves. This visual progress often motivates people to stay consistent with their money goals.

This Platform for Everyday Money Management

Daily money decisions matter, and Nerd Wallet helps with that too. From budgeting advice to tips on reducing expenses, the platform provides easy-to-follow guides. With these, users can make small changes that add up to big results.

For example, if someone wants to save more each month, they can read step-by-step articles on cutting costs. Because the tips are practical, they can be applied immediately in everyday life. This makes the platform useful for both short-term and long-term financial planning.

Nerd Wallet vs. Traditional Advisors

Some people wonder if Nerd Wallet replaces traditional financial advisors. While it does not give personalized investment plans, it does provide enough resources for general money management. Many users prefer it because it is free, while financial advisors often charge high fees.

Additionally, the platform updates information regularly. Since financial products change often, Nerd Wallet keeps its comparisons fresh. This ensures users always have the most accurate data available.

Tips for Using the Platform Effectively

If you want the best results, use Nerd Wallet consistently. Checking your credit score regularly helps you spot mistakes early. Comparing financial products before making a decision ensures you avoid costly errors.

Also, try using more than one feature. For example, combine the net worth tracker with budgeting tips. This gives you a complete picture of your financial health and makes reaching goals much easier.

Advantages of the Platform

There are many reasons people enjoy using this platform. The first advantage is convenience—everything is in one place. Whether you want a new credit card or simply check your credit score, you do not need to visit multiple websites.

The second advantage is clarity. With simple guides and clear comparisons, Nerd Wallet removes confusion. Even complicated topics like mortgages become easier to understand when explained step by step.

Limitations of Nerd Wallet

Even though the platform is useful, it is important to know its limits. It does not replace professional financial advice for people with complex needs. For example, if someone is planning for retirement investments, they may still need expert help.

Another limitation is that recommendations may not fit everyone. Because financial goals are different, a product that works for one person may not be the best for another. Therefore, users should always think carefully before making final decisions.

Final Thoughts

In conclusion, Nerd Wallet is a powerful tool for anyone who wants to make smarter financial decisions. From comparing financial products to tracking net worth and improving credit scores, it offers a wide range of free features.

While it does not fully replace professional advice, it is a helpful starting point for most people. By using it regularly and exploring its tools, you can take control of your money and build a stronger financial future.

FAQs

Q1. What is Nerd Wallet?

Nerd Wallet is an online financial platform that helps people make smarter money decisions. It provides comparisons of financial products, tools to track credit score, and resources to calculate net worth.

Q2. Is free to use?

Yes, Nerd Wallet is completely free. You can check your credit score, compare financial products, and access educational resources without paying any fees.

Q3. How does make money if it’s free?

Nerd Wallet earns money through partnerships. When users choose financial products like credit cards or loans through the site, the company may receive a commission from providers.

Q4. Can help me track my net worth?

Yes, it offers tools to calculate and track your net worth. You can link accounts or manually add details about assets and debts to see your financial progress over time.

Q5. Does the platform affect my credit score?

No, checking your credit score with Nerd Wallet does not affect it. The platform uses a “soft inquiry,” which does not harm your score in any way.

Visit our website: Organize Blogs